Online bookkeeping services typically offer a dedicated contact or team — but these are still virtual bookkeepers, available by email or occasionally by phone. If you don’t want to communicate virtually, these bookkeeper interview questions can help you find a resource near you. While https://www.kelleysbookkeeping.com/comparative-balance-sheet-definition/ 1-800Accountant offers less expensive plans that may be useful for businesses that need only tax advice and quarterly reviews, only its most expensive Enterprise plan comes with bookkeeping services. Outsourcing bookkeeping services means you have to pay less than these numbers.

Produce thorough reports

If that sounds familiar, you might want to consider outsourced bookkeeping. At the same time, bookkeeping is a relatively manual, labor-intensive process that takes up a significant amount of time. Organizing all of your business’s financial data into a centralized, accurate record is a monotonous task. Although technology has streamlined the process somewhat, bookkeeping remains a challenge for many business owners.

How Much Does It Cost to Outsource Bookkeeping?

Yes, outsourcing accounting can offer substantial cost savings compared to in-house solutions, even when evaluating similarly skilled providers. This is especially true for US-based companies looking to outsource, whether at home or overseas. Customize plans to include other services like accounts receivable processing, inventory reconciliation and payroll support.

Enabling Non-Profit Organizations to Focus on Their Mission, While We Ensure Accurate & Reliable Accounting Services

However, Merritt can still recommend a solid payroll provider or tax consultant who meets your needs. But Merritt Bookkeeping’s most stand-out feature might be its in-depth financial reports. Most other virtual bookkeeping services give you basic financial reports only, like income statements and balance sheets. https://www.online-accounting.net/ In contrast, Merritt gives you more detailed reports like forecasting and quarterly comparisons. Merritt Bookkeeping automates some of the most time-consuming bookkeeping tasks — for instance, reconciling accounts, balancing books, and updating financial reports — so you can focus on running your business.

- Affordable plans start at under $100 per month, perfect for small businesses or startups that need basic bookkeeping and financial reporting.

- Unearned revenue may be a liability on the books but it does have many benefits for small business owners.

- In-house bookkeeping often relies on the skills and knowledge of one or a few individuals, which can be limiting.

- Outsourced bookkeepers can be hired on a contract basis or as full-time staff members.

- Another major risk is receiving low-quality accounting and bookkeeping services, an issue that can be mitigated by using a local or well-established accounting and finance team.

Having somebody outside of your company who is managing bookkeeping and financial records can take a huge chunk of time off your plate. They can deal with legal compliance, employee wages, paying suppliers, managing expenses, and everything else, so you can focus on other aspects of running a company. Learn how to overcome the accounting staffing crisis from the CEO of the company leading the outsourced accounting movement. If there’s no one on staff with bookkeeping experience, it might make sense for your company to hire someone specializing in this area.

Save Thousands on Staff

And the more complex your business’s financials, the more likely you’ll want to bring on a dedicated bookkeeping service. Lots of bookkeeping services are built to run on QuickBooks, an industry leader in accounting and bookkeeping software. Some services also support Xero, another popular cloud-based accounting software. If you’re comfortable with your current software, ensure your bookkeeping service supports it.

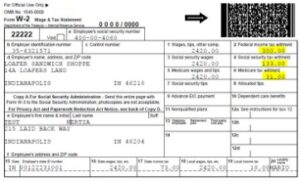

Bookkeepers use an accounting journal or an online accounting program to keep track of each transaction and the purpose of the transaction. Bookkeepers also handle payroll and payroll taxes, send invoices, handle accounts payable and keep track of overdue accounts. Without a great bookkeeper, your company could be losing thousands of dollars each period. It’s up to you to determine whether your business can afford an in-house bookkeeper. Their standard pay, according to Salary.com, ranges from $39,568 and $50,577 per year—before taking into account payroll taxes and employee benefits. That can be a lot if you simply need someone to perform bank reconciliations and forecasting.

Examine your choices and look for a company that uses a bookkeeping software you’re familiar with, has positive user reviews, and has worked in the field for some time now. Offshore bookkeeper companies are located in India and other countries, where it costs less to hire such service providers. This allows offshore bookkeepers to offer more affordable fees for bookkeeping.

An outsourced CFO that’s experienced in the nonprofit sector might not grasp the financial challenges that a fast-growing technology company deals with. As you evaluate different outsourced CFO options, there are several things to bear in mind to ensure you make the right choice. By keeping these considerations in mind, you’ll be able to avoid any of the drawbacks that can impact businesses that partner with an outsourced does payable interest go on an income statement CFO that isn’t a great fit for their business. Much like outsourced bookkeeping, there are few disadvantages inherent in partnering with an outsourced controller. With the right partner, it’s possible to mitigate these downsides entirely, but to do that, you need to be aware of what to be on the lookout for. Outsourcing your bookkeeping tasks can make a significant difference in the day-to-day operations of your business.

Ideally, the monthly plan would be more economical but you also get a pay-as-you-go option that even lets you pay on an hourly basis. According to GrowthForce, outsourcing your bookkeeping will come with a price tag that spans anywhere from $500 to $2,500 per month. The main factors that will impact the cost are the number and complexity of services needed.

When you work with Ignite Spot Accounting, you’ll get bookkeepers certified in a variety of popular programs, such as QuickBooks and TSheets. If you choose its chief financial officer (CFO) services, your CFO will be a certified public accountant (CPA) at a minimum. Its features include automation of tasks, Gusto payroll processing, balance sheet production, income statements, accuracy checks and transaction databases. Ignite Spot Accounting delivers heftier reports than many other cloud accounting providers we checked out for this piece.

Whichever service provider you choose, we recommend you to read reviews of businesses similar to yours to see the quality of service others have received. Choose a service provider that has a responsive team of accountants who can be easily reached through phone, text, or email. Since you do not want your financial information in the wrong hands make sure the service provider you choose follows all data security and data privacy compliances. The accounting service that you will choose will handle sensitive financial information about your business which is always at a risk of a data breach. SmartBooks not only takes care of the bookkeeping for small businesses but provides many other valuable financial services to help small businesses manage their accounts and financial health with ease.