For example, regression analysis might reveal that a 10% increase in supplier lead time results in a 5% increase in material quantity variance. Armed with this knowledge, companies can focus their efforts on improving supplier lead times to achieve better cost control. Additionally, the use of variance decomposition allows businesses to break down complex variances into more manageable components, providing deeper insights into specific areas of concern. As businesses strive for greater precision in cost management, advanced techniques in variance analysis have become increasingly valuable. One such technique is the use of trend analysis, which involves examining variance data over multiple periods to identify patterns and trends. By understanding these trends, companies can anticipate future variances and take proactive measures to mitigate them.

Causes of unfavorable direct materials quantity variance

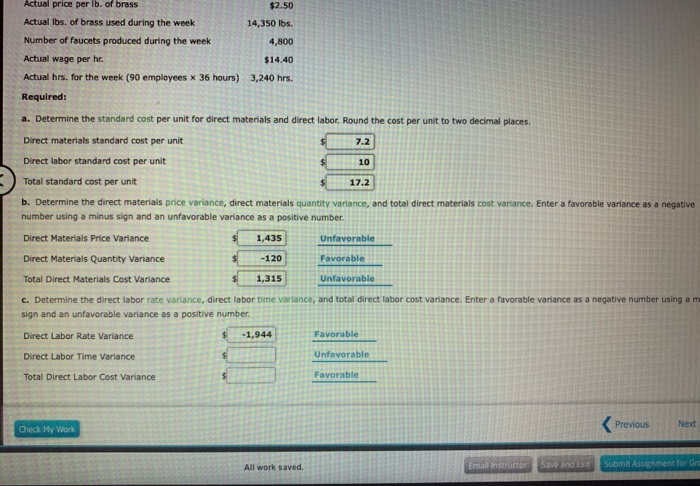

Throughout our explanation of standard costing we showed you how to calculate the variances. In the case of direct materials and direct labor, the variances were recorded in specific general ledger accounts. The manufacturing overhead variances were the differences between the accounts containing the actual costs and the accounts containing the applied costs. Understanding direct material variance is crucial for businesses aiming to maintain cost efficiency and improve profitability.

Direct Material Quantity Variance

Before we take a look at the direct materials efficiency variance, let’s check your understanding of the cost variance. Our purchasing department was able to find materials for less than our standard, saving us a significant amount of money, which in turn improves the bottom line, which means this is a favorable variance. We could interpret the negative number as “below expectations” which is possibly a good thing when it comes to cost. However, it is also possible that we gained those cost reductions by buying lesser quality raw materials which could hurt us in the long run. When considering the reasons behind a favorable or unfavorable budget variance, one must also consider if the variances were actually controllable or not. If the variance was ‘controllable’, it means the costs incurred were originally within management’s ability to control.

6 Direct Materials Variances

When setting a standard price, they consider factors such as market conditions, vendors’ quoted prices, and the optimum size of a purchase order. A direct materials cost variance (sometimes called a materials price variance or MPV) occurs when a company pays a higher or lower price than the standard price set for materials. There are two components to a direct materials variance, the direct materials price variance and the direct materials quantity variance, which both compare the actual price or amount used to the standard amount. The standard cost of actual quantity purchased is calculated by multiplying the standard price with the actual quantity. This amount will represent the expected expenditure on direct material for this many units. The difference between this actual expenditure and the actual expenditure on direct material is the direct materials price variance.

We now have spent $31,250 on our raw materials, when we had budgeted $21,000. Waste, scrap, production issues or improper training could all have been at fault for this variance issue. The direct material variance is also known as the direct material total variance. The direct material variance is usually charged to the cost of goods sold in the period incurred.

- For example, regression analysis might reveal that a 10% increase in supplier lead time results in a 5% increase in material quantity variance.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- Throughout our explanation of standard costing we showed you how to calculate the variances.

Inefficient production processes, outdated machinery, or inadequate employee training can result in higher material consumption than planned. Implementing lean manufacturing techniques, investing in modern equipment, and providing ongoing training for employees can enhance production efficiency and reduce 2 ways to increase profit margin with value material waste. Additionally, regular audits of the production process can identify areas for improvement and help maintain optimal material usage. Each bottle has a standard material cost of 8 ounces at $0.85 per ounce. Calculate the material price variance and the material quantity variance.

GR Spring and Stamping, Inc., asupplier of stampings to automotive companies, was generatingpretax profit margins of about 3 percent prior to the increase insteel prices. Let’s say our accounting records show that the company bought 6,800 board feet of lumber for that $38,080.

Recall from Figure 10.1 that the direct materials standard pricefor Jerry’s is $1 per pound, and the standard quantity of directmaterials is 2 pounds per unit. Figure 10.4 shows how to calculatethe materials price and quantity variances given the actual resultsand standards information. Review this figure carefully beforemoving on to the next section where these calculations areexplained in detail. Let’s assume that you decide to hire an unskilled worker for $9 per hour instead of a skilled worker for the standard cost of $15 per hour. Angro Limited, a single product American company, employs a proper standard costing system. The normal wastage and inefficiencies are taken into account while setting direct materials price and quantity standards.

Like direct materials price variance, this variance may be favorable or unfavorable. If workers manufacture a certain number of units using a quantity of materials that is less than the quantity allowed by standards for that number of units, the variance is known as favorable direct materials quantity variance. On the other hand, if workers use the quantity that is more than the quantity allowed by standards, the variance is known as unfavorable direct materials quantity variance.