Meredith is frequently sought out for her expertise in small business lending and financial management. Understand the qualitative aspects of entire industries or specific companies. F1[b], F1[e] – Statement of financial position (at the [b]eginning and at the [e]nd of the analizing period).

How confident are you in your long term financial plan?

The asset turnover ratio can vary widely from one industry to the next, so comparing the ratios of different sectors like a retail company with a telecommunications company would not be productive. Comparisons are only meaningful when they are made for different companies within the same sector. 2021 guide to selling products online Asset turnover ratio is one of the most crucial business stats and accounting formulas to know. Plus, the asset turnover ratio can come in handy when you’re looking into business funding. Total asset turnover ratio is a key driver of return on equity as discussed in the DuPont analysis.

To Ensure One Vote Per Person, Please Include the Following Info

Assuming the company had no returns for the year, its net sales for the year were $10 billion. The company’s average total assets for the year was $4 billion (($3 billion + $5 billion) / 2 ). The asset turnover ratio is expressed as a rational number that may be a whole number or may include a decimal. By dividing the number of days in the year by the asset turnover ratio, an investor can determine how many days it takes for the company to convert all of its assets into revenue. To calculate the ratio in Year 1, we’ll divide Year 1 sales ($300m) by the average between the Year 0 and Year 1 total asset balances ($145m and $156m).

Asset Turnover Ratio: Formula, Examples, How to Improve It

Sally’s Tech Company is a tech start up company that manufactures a new tablet computer. Sally is currently looking for new investors and has a meeting with an angel investor. The investor wants to know how well Sally uses her assets to produce sales, so he asks for her financial statements.

In other words, every $1 in assets that the company owns generated $0.25 in net sales revenue. Again, this can be helpful when using various business valuation methods and trying to determine whether an investment fits your overall strategy. Remember to compare this figure with the industry average to see how efficient the organization really is in using its total assets. Average total assets are found by taking the average of the beginning and ending assets of the period being analyzed. The standard asset turnover ratio considers all asset classes including current assets, long-term assets, and other assets.

Step 2: Find your average total assets.

The ratio is typically calculated on an annual basis, though any time period can be selected. As at 1 January 20X1, Gamma had total assets of $100, total fixed assets of $60 and net working capital of $20. During FY 20X1 it generated sales of $200 with COGS of $160 and its total assets as at 30 December 20X1 were $120. During the year it charged depreciation of $10 and there were no fixed asset additions during the year.

- For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing.

- Meanwhile, firms in sectors like utilities or manufacturing tend to have large asset bases, which translates to lower asset turnover.

- At the same time, we will also include assets that can easily convert into cash.

- Analysts and investors often compare a company’s most recent ratio to historical ratios, ratio values from peer companies, or average ratios for the company’s industry.

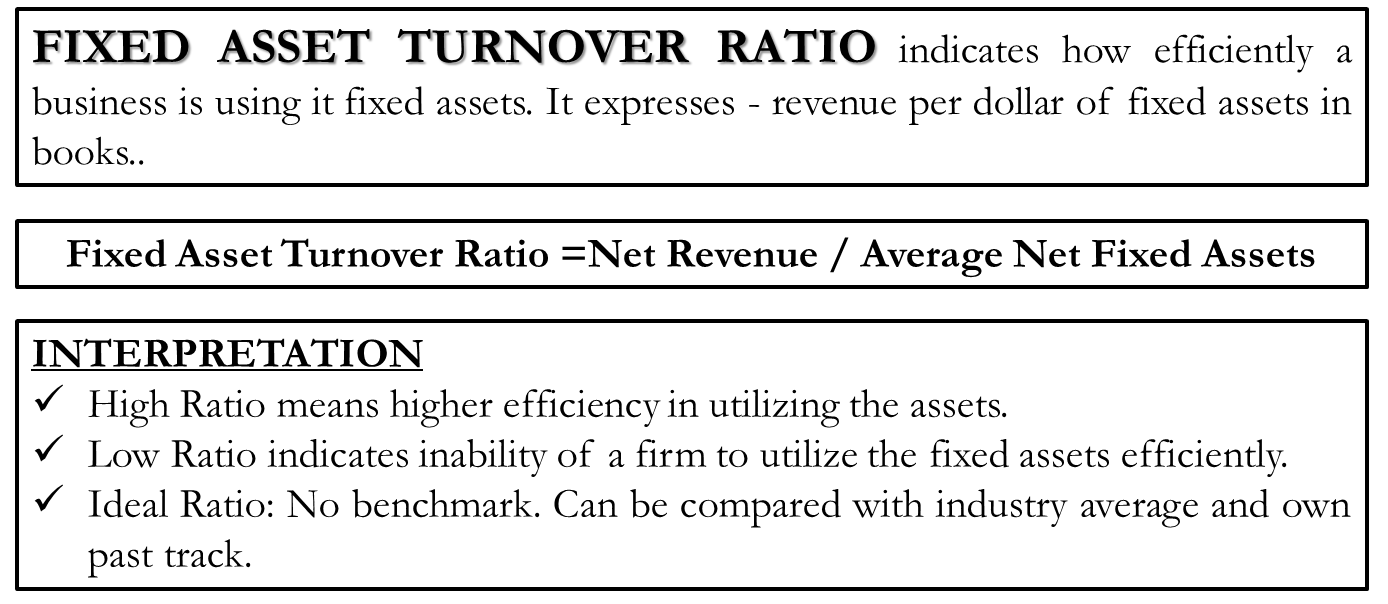

On the other hand, fixed asset turnover ratio looks at a company’s fixed assets to measure performance. The fixed asset turnover ratio formula divides a company’s net sales by the value of its average fixed assets. Asset turnover ratios vary across different industry sectors, so only the ratios of companies that are in the same sector should be compared. For example, retail or service sector companies have relatively small asset bases combined with high sales volume.

Thus, a sustainable balance must be struck between being efficient while also spending enough to be at the forefront of any new industry shifts. Companies should strive to maximize the benefits received from their assets on hand, which tends to coincide with the objective of minimizing any operating waste. She has specialized in financial advice for small business owners for almost a decade.