Contents

The forex market is open 24 hours, five days a week – Monday to Friday. Trading begins with the opening of the market in Australia, followed by Asia, and then Europe, followed by the US market until the markets close on the weekend. The only market open on the weekend is the cryptocurrency market.

However, if that same investor thinks the Euro will decline relative to the US dollar, they can sell the EUR/USD by opening a sell position for one lot of that pair. Market participants can trade in the spot market and also buy and sell derivatives. The forex market is by far one of the most liquid of the global asset markets. Citi Global Chief Economist Nathan Sheets speaks with Yahoo Finance Live about inflation, global recession risks, central bank policies, and more. For more information on how to start forex trading from home, read our step-by-step guide here.

Now, when you’re trading forex, you’ll be trading currency pairs. So, two different currencies will be involved, and you’ll be speculating about their value in relation to each other. As an acronym for ‘price in point’ or ‘percentage in point’, a pip is the fourth decimal point used in pricing. As most currency pairs are priced to 4 decimal points, it’s the smallest price move that an exchange rate can make (0.0001). Like every investment, there are risks and rewards with forex trading. To try out forex without risking any real money, look for a brokerage with paper trading, which works like a stock market game.

Foreign exchange market

They display the closing trading price for the currency for the time periods specified by the user. The trend lines identified in a line chart can be used to devise trading strategies. For example, you can use the information contained in a trend line to identify breakouts or a change in trend for rising or declining prices. In a swing trade, the trader holds the position for a period longer than a day; i.e., they may hold the position for days or weeks. Swing trades can be useful during major announcements by governments or times of economic tumult. Since they have a longer time horizon, swing trades do not require constant monitoring of the markets throughout the day.

In addition, if a currency falls too much in value, leverage users open themselves up to margin calls, which may force them to sell their securities purchased with borrowed funds at a loss. Outside of possible losses, transaction costs can also add up and possibly eat into what was a profitable trade. Because of those large lot sizes, some traders may not be willing to put up so much money to execute a trade. Leverage, another term for borrowing money, allows traders to participate in the forex market without the amount of money otherwise required. The risks of loss from investing in CFDs can be substantial and the value of your investments may fluctuate. You should consider whether you understand how this product works, and whether you can afford to take the high risk of losing your money.

Originally, the focus was on partial equilibrium models that captured the key features of FX trading. Recent micro-based research moves away from the traditional partial equilibrium domain of microstructure models to focus on the link between currency trading and macroeconomic conditions. This research aims to provide the microfoundations of the exchange rate dynamics that have been missing in general equilibrium macro models.

Keep in mind that trading with margin may be subject to taxation. PrimeXBT shall not be responsible for withholding, collecting, reporting, paying, settling and/or remitting any taxes which may arise from Your participation in the trading with margin. The candlestick has a body and wicks both above and below that body. The “body” of the candle will tell you the opening and closing price and is colored according to the timeframe either being a rise or fall in price.

Unless there is a parallel increase in supply for the currency, the disparity between supply and demand will cause its price to increase. Similarly, a piece of negative news can cause investment to decrease and lower a currency’s price. This is why currencies tend to reflect the reported economic health of the region they represent. Supply is controlled by central banks, who can announce measures that will have a significant effect on their currency’s price. Quantitative easing, for instance, involves injecting more money into an economy, and can cause its currency’s price to drop.

What is The History of Forex Trading?

To open an account with your broker you’ll also need to submit some documentation so that we can verify who you are. One of the first things you’ll need is a stable internet connection, as forex trading is done online. The most important factor is that your connection is stable and readily available. This is especially important for monitoring your trades and accessing your account should you need to make changes or catch an opportunity. To buy or sell foreign currency, you need a brokerage account that supports this type of asset.

FXCM offers a variety of webinar types, each designed to cater to your trading needs. Daily entries cover the fundamental market drivers of the German, London and New York sessions. Wednesdays bring The Crypto Minute, a weekly roundup of the pressing news facing cryptocurrencies. In addition, a library of past recordings and guest speakers are available to access at your leisure in FXCM’s free, live online classroom. Trading lower leverage ensures that you have enough capital to become experienced in the market.

If you’re new to forex, you can begin exploring the markets by trading on our demo account, risk-free. One critical feature of the forex market is that there is no central marketplace or exchange in a central location, as all trading is done electronically via computer networks. While the average investor probably shouldn’t dabble in the forex market, what happens there does affect all of us.

Risks of Investing in Forex

As the old adage goes, practice makes perfect; while perfection is often elusive for active traders, being prepared for every session should be routine. There are several key differences between swapping currencies abroad and buying or selling forex. Waiver of NASDAQ Level II and Streaming News subscription fees applies to non-professional clients only. Access to real-time market data is conditioned on acceptance of exchange agreements. Once set up, if an investor thinks that the US dollar will rise compared to the Japanese Yen, they could buy the US dollar and sell the Yen.

Every day there’s trillions of dollars traded on the Forex Market, making it the largest financial market in terms of sheer volume traded. However, this used to only be available to the likes of big banks, financial institutions, huge corporations, and hedge funds. As technology has developed though, smaller investors like individual traders can now access the market and become retail traders! This has all been made possible by the existence of Forex Brokers.

How long will it take me to learn forex trading?

With some hard work and dedication, it should take you 12 months to learn how to trade Forex / trade other markets – it's no coincidence our mentoring program lasts 12 months! You will always be learning with the trading and must always be ready to adapt and change, but that's part of the thrill and challenge.

They are visually more appealing and easier to read than the chart types described above. A down candle represents a period of declining prices and is shaded red or black, while an up candle is a period of increasing prices and is shaded green or white. Forex markets exist as spot markets as well as derivatives markets, offering forwards, futures, options, and currency swaps. So, basically a trader would use forex to hedge against other positions in other asset classes or for other forex positions. Generally, the account types that are available depend on the volume that you’ll be trading.

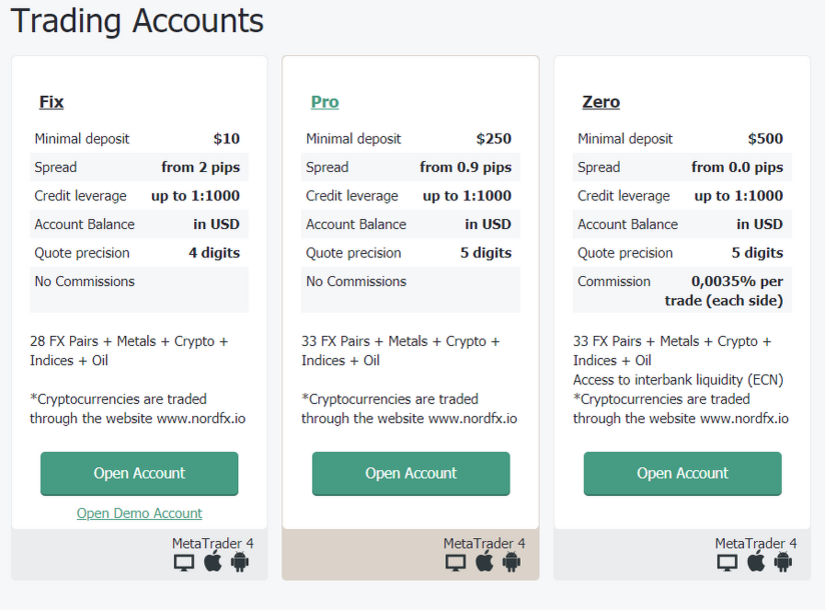

Accounts

There in the 17th century was established the first forex market, which was operating between England and Holland. It comes with leverage which makes it possible to enter the trade with a smaller amount of investment. A distinct example of how economic changes can impact currencies is the U.S. Dollar Index’s five day rising streak due to the possibility of higher inflation and Fed’s bond-purchasing program in November of 2021. This is due to the fact that the U.S. dollar is highly sensitive to inflation.

Since there is no ‘lead’ market, forex trading hours are generally based around when trading is open in a participating country. London and New York’s trading sessions overlap, so there is often a lot of trading volume during this time of day. Foreign exchange rates are determined for the next 24-hour period at 4pm London/UTC time. Microstructure examine the determination and behavior of spot exchange rates in an environment that replicates the key features of trading in the foreign exchange market. Traditional macro exchange rate models pay little attention to how trading in the FX market actually takes place.

What the currency exchange quote is telling you is the price of one euro in dollars. Trading Forex pairs is fundamentally the buying of one currency and the selling of another. The first currency is known as the ‘Base’ and the second currency is known as the ‘Quote’.

What are Foreign Exchange Markets?

This makes it easy to enter and exit apositionin any of the major currencies within a fraction of a second for a small spread in most market conditions. Much like other instances in which they are used, bar charts are used to represent specific time periods for trading. Each bar chart represents one day of trading and contains the opening price, best mt4 broker highest price, lowest price, and closing price for a trade. A dash on the left is the day’s opening price, and a similar dash on the right represents the closing price. Colors are sometimes used to indicate price movement, with green or white used for periods of rising prices and red or black for a period during which prices declined.

You go up to the counter and notice a screen displaying different exchange rates for different currencies. In this view, countries may develop unsustainable economic bubbles or otherwise mishandle their national economies, and foreign exchange speculators made the inevitable collapse happen sooner. A relatively quick collapse might even be preferable to continued economic mishandling, followed by an eventual, larger, collapse. Mahathir Mohamad and other critics of speculation are viewed as trying to deflect the blame from themselves for having caused the unsustainable economic conditions.

Nial Fuller is a professional trader, author & coach who is considered ‘The Authority’ on Price Action Trading. He has taught over 25,000 students via his Price Action Trading Course since 2008. In almost all countries on earth, FX trading is perfectly legal. If you have questions, you should look to your local regulatory agency to make sure. The amount of a currency in circulation also began to play a key role in its value as well. Learn how to benefit from currency movements by trading FX at PrimeXBT.

If traders believe that a currency is headed in a certain direction, they will trade accordingly and may convince others to follow suit, increasing or decreasing demand. If the pound rises against the dollar, then a single pound will be worth more dollars and the pair’s price will increase. So if you think that the base currency in a pair is likely to strengthen against the quote currency, you can buy the pair . The extensive use of leverage in forex trading means that you can start with little capital and multiply your profits.

Can I get rich by trading forex?

Forex Trading is NOT a Get-Rich-Quick Scheme. Forex trading is a SKILL that takes TIME to learn. Skilled traders can and do make money in this field. However, like any other occupation or career, success doesn't just happen overnight.

There’s plenty of time to implement higher degrees of leverage once you gain competency and security in the marketplace. Like all markets, forex features a unique collection of pros and cons. For any aspiring currency market participant, it’s important to conduct adequate due diligence and decide if forex trading is a suitable endeavour.

What is trading?

Once you understand it and how to calculate your trade profit, you’re one step closer to your first currency trade. The forex market uses symbols to designate specific currency pairs. The euro is symbolized by EUR, the U.S. dollar is USD, so the euro/U.S. Other commonly traded currency symbols include AUD , GBP , CHF , CAD , NZD , and JPY . Foreign exchange, better known as “forex,” is the largest financial market in the world.

If you’re just starting out, make sure to tread carefully and make sure you understand the trades you’re placing and how they can go wrong. Most forex trading occurs in London, followed by New York, Singapore and Hong Kong. Some thought the U.K.’s decision to leave the European Union would dent London’s spot as the largest forex market, but that has not proven to be the case. Today, forex trading is done mostly by banks on behalf of clients, and trading occurs 24 hours a day from 5 p.m. Every day brings a whole host of headlines about the financial markets. Get daily investment insights and analysis from our financial experts.

If you guess the direction of the market correctly, you can benefit from price changes. A ‘lot’ in forex trading refers to the number of units of a base currency. Choose from a variety of global markets to trade with Axi, using ultra competitive spreads & flexible leverage to trade your edge.

Compared to the “measly” $22.4 billion per day volume of the New York Stock Exchange , the foreign exchange market looks absolutely ginormous with its $6.6 TRILLION a day trade volume. On 1 January 1981, as part of changes beginning during 1978, the People’s Bank of China allowed certain NordFX Forex Broker domestic “enterprises” to participate in foreign exchange trading. Sometime during 1981, the South Korean government ended Forex controls and allowed free trade to occur for the first time. During 1988, the country’s government accepted the IMF quota for international trade.

The foreign exchange market and derivatives such as CFDs , Non-Deliverable Bitcoin Settled Products and Short-Term Bitcoin Settled Contracts involve a high degree of risk. They require a good level of financial knowledge and experience. Forex markets have a few basic trading strategies that you should be aware of. In a long trade, they are betting that the currency price will increase in the future, and they will be able to collect profits. In a short trade, they are betting that the currency price will decrease over time, offering profits as well. Learning forex trading involves getting to know a small amount of new terminology that describes the price of currency pairs.

This creates daily volatility that may offer a forex trader new opportunities. Online trading platforms provided by global brokers like FXTM mean you can buy and sell currencies from your phone, laptop, tablet or PC. Forex is traded on the forex market, which is open to buy and sell currencies 24 hours a day, five days a week and is used by banks, businesses, investment firms, hedge funds and retail traders. Currencies are traded in the foreign exchange market, a global marketplace that’s open 24 hours a day Monday through Friday. All forex trading is conducted over the counter , meaning there’s no physical exchange and a global network of banks and other financial institutions oversee the market . Forex, also known as foreign exchange or FX trading, is the conversion of one currency into another.

Although leveraged products can magnify your profits, they can also magnify losses if the market moves against you. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. A spot trade is the purchase or momentum scalper sale of a foreign currency or commodity for immediate delivery. The foreign exchange is the conversion of one currency into another currency. In a position trade, the trader holds the currency for a long period of time, lasting for as long as months or even years.

You’ll need to become very familiar with the term ‘Pip’ if you’re going to indulge in online forex trading. Forex is an exciting place to invest, but it’s a more expert area of the investment landscape. Newer investors should start with less risky assets before dabbling in currencies. Less predictable markets — When investing in U.S. stocks, you can count on company guidance, financial reports, and other data to predict the future.