Now one bookkeeper can manage the bookkeeping for several businesses in fewer than eight hours a day. FreshBooks accounting software makes it easier than ever for large companies like yours to get paid for your services with simple, secure online payments. Clients can pay by credit card straight from an invoice with just a couple of quick clicks. With high-level encryption and first-class security, your customers don’t have to worry about payment protection. FreshBooks offers a transparent, affordable fee structure to remove the guesswork from online payments for businesses.

Karen Lang Obituary – Times Recorder – Zanesville Times Recorder

Karen Lang Obituary – Times Recorder.

Posted: Sun, 20 Aug 2023 13:40:51 GMT [source]

As we mentioned above, you don’t technically need to be certified to run a bookkeeping business. A business plan involves outlining your plans for your company in detail. It is a comprehensive document that explains not only your services but also your market and the competitive advantage you’ll have in your business. It’ll help you focus your business and run efficiently out of the gate. When you have a Small Business Plus plan or higher, you get unlimited online support. All plans come with onboarding, a dedicated bookkeeper and account manager, reconciliation at month-end, balance sheet, P&L, statement of cash flows and a portal with document storage.

What Is Accounting Software?

Go Answer is a bilingual answering service that connects your customers to live customer service agents via phone, text, web chat, or email 24/7. Hourly rates for internal, part-time average around $21-23/hour depending on job description and location.[1] They typically are performing basic bookkeeping duties and will need to be supervised and managed. They focus on recording the financial transactions of a business through maintaining records, tracking transactions, and creating financial reports. Bookkeepers are in charge of maintaining your books closely day in and day out.

An accountant may interpret the financial records put together by a bookkeeper to assess a company’s financial health. Becoming an accountant usually requires more training and education than bookkeeping but can be a good next step in your financial career. If you find that you have a talent for and enjoy the process, you may Bookkeeping for large business consider starting your own bookkeeping business providing this service to others. There’s always a demand for experienced, efficient bookkeepers in nearly every industry. Companies often outsource the organization of their finances to independent professionals, then hire accountants for more complex issues and tax filing.

Choose What Services You’ll Offer

The project manager will identify stakeholders and project team members across Intuit and your firm, and will create both a full project plan and a high-level presentation. The project manager will also schedule recurring meetings and report-outs, keeping teams on track to meet each milestone. We can assign a dedicated project manager to work with your firm as you undergo the platform shift to QuickBooks Online. But accounting solutions should consolidate data from each business and generate reports from this data for streamlined visibility. In this article, we’ll be looking at the top software tools for multibusiness management in 2023.

It can also be a great way to track your business expenses easily—this will go a long way toward making tax time a breeze. If either part-time or in-house bookkeeping is not the ideal solution, switching to outsourced bookkeeping or accounting could be your best option. Many businesses are concerned about switching over to outsourcing, not understanding how the pieces fit together with this model.

What Is Bookkeeping? Definition, Tasks, Terms to Know

Learn the benefits of starting out on your own small business venture that will encourage you to take that leap. Small businesses are most often prone to outsourcing their bookkeeping to third parties. However, any error or oversight that may appear on the sheet is fully at your business’s expense. But if it’s more complex, like building out your financial outlook, you might be better off with hiring an accountant. As you’ve seen, there are several solutions to this bookkeeping dilemma, but they also come with additional questions you should keep in mind before making a decision.

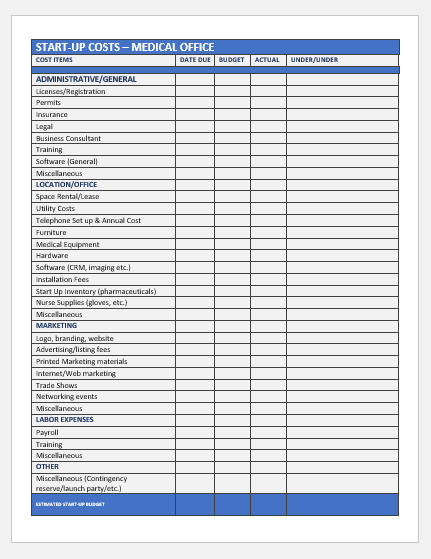

Bookkeeping is a great home-based business that’s easy to start with very little cash. Accounting software makes it possible to do much of this on your own, though you may decide to outsource some basic bookkeeping tasks to an online bookkeeping service as your small business grows. Reference your initial business plan — what type of clientele are you aiming to serve? Hopefully, you now have a better idea of what bookkeeping services you can afford and which services come with a lower or higher bookkeeper cost. Consider investing in simple software like FreshBooks for additional help in handling your finances without breaking the bank. It’s also important to make sure they have experience in accounting software you use.

Sage has hundreds of bank integrations (including popular choices like Chase and Wells Fargo), meaning it will likely work for you. I don’t recommend inviting clients to your home office unless you know them very well and have a private room where you can work. Read our home office setup ideas to learn about the must-haves and productivity hacks. As a one-person operation, you may find it hard to get back to clients right away, especially during tax season. Sending prospective customers to voicemail when they need your services can cost you business.

Do I need to rent office space for my bookkeeping business?

Bookkeeping can be tedious and time-consuming, but it doesn’t have to be. This blog post will cover three tips to help large business owners with their bookkeeping. Even smaller businesses may notice certain missing features, like time and mileage tracking. Likewise, if you plan to use mobile receipt tracking, you should know that Sage Accounting charges extra for that feature. Sage Accounting lets you create and send unlimited invoices ― unlike other software that often limits how many you can send per month.

- FreshBooks gives important financial insights to help you take your large company to the next level.

- Its trulysmall.invoices plan is perfect for sending an invoice, getting paid and tracking payments.

- In addition to these basic bookkeeping activities, your costs will be impacted by how your accounting systems, policies and procedures, and reporting needs are set up and administered.

- Sage also gives you the option to accept payments by adding a “Pay Now” button onto your invoice.

- If you enjoy organization and numbers and have experience with bookkeeping, starting your own business offering this service might be a smart career choice.

It’s much easier to become an expert in accounting for a particular business niche than for all businesses in general. Small businesses often work with tax advisors to help prepare their tax returns, file them and make sure they’re taking advantage of small-business tax deductions. Though you may not work regularly with a tax specialist year-round, you’ll want to connect with one sooner rather than later so you’re not rushed come tax time. When you dial in your business structure, accounting system, brand, and target audience, you’re ready to showcase it on a professional bookkeeping website. Another aspect of marketing is dialing in your brand, which goes hand in hand with the type of clients you want to bring in. Knowing the market and what makes you stand out from other competitors will naturally draw your potential client base to your bookkeeping services.

Cash-Based Accounting

In this day and age, the providers you contract with don’t need to be in the same city, state or even time zone as you. Remote work has expanded across nearly every field, including bookkeeping. If you find someone who is a good fit for your business needs, it doesn’t matter if they are in California while you work from New York. You’ll want to create a contract that outlines details, such as deadlines, rates and expectations so that everyone is on the same page.

Additionally, a bookkeeper may work with an accountant, who is responsible for more advanced tasks such as assessing the health of a business or generating financial statements. According to Glassdoor, it costs about $42,000 a year to hire a bookkeeper for your small business. But, this cost can vary based on additional factors such as your bookkeeping needs and where you run your business. Most accounting software providers offer free trials, so you can try out the software before you commit to it.

The plan includes unlimited expense tracking, unlimited estimates, accept credit cards and bank transfers, track sales, see reports and send unlimited invoices to up to five clients. If you have less than $50,000 per year in revenue, you can sign up for the Zoho Books Free plan. It gives one user access, enabling them to manage clients and invoices, create recurring invoices, import bank and credit card statements, and track expenses and mileage. Both accountants and bookkeepers work to maintain accurate records of finances, and sometimes the terms are used interchangeably. Generally, bookkeepers focus on administrative tasks, such as completing payroll and recording incoming and outgoing finances.

Luckily, multibusiness accounting software streamlines all accounting and bookkeeping operations for users, enabling them to manage their strategies without losing their minds. Get started using simple cloud-based accounting software for your large company with a free 30-day trial. FreshBooks lets you test out its easy-to-use features for a full 30 days before committing — no strings attached and no fine print. Similarly, you don’t notate outstanding bills until you actually pay them.

Xero is one of the most popular accounting software for small businesses. The Early plan costs $13 per month and includes basic features such as bank account reconciliation, bill and receipt capturing and short-term cash flow and business snapshot. Online bookkeeping services can save business owners both time and money. With hundreds of options, however, it can be daunting to sort through them all and find the best service for your business. We’ve analyzed the best bookkeeping services to help you find the right solution quickly and easily.