However, when using our compound interest rate calculator, you will need to provide this information in the appropriate fields. Don’t worry if you just want to find the time in which the given interest rate would double your investment; just type in any numbers (for example, 111 and 222). As the main focus of the calculator is the compounding mechanism, we designed a chart where you can follow the progress of the annual interest balances visually. If you choose a higher than yearly compounding frequency, the diagram will display the resulting extra or additional part of interest gained over yearly compounding by the higher frequency. Thus, in this way, you can easily observe the real power of compounding.

It is also worth knowing that exactly the same calculations may be used to compute when the investment would triple (or multiply by any number, in fact). All you need to do is just use a different multiple of P in the second step of the above example. If you include regular deposits or withdrawals in your calculation, we switch to provide you with a Time-Weighted Rate of Return (TWR). For the remainder of the article, we’ll look at how compound interest provides positive benefits for savings and investments. Use the tables below to copy and paste compound interest formulas you need to make these calculations in a spreadsheet such as Microsoft Excel, Google Sheets and Apple Numbers. The compound interest calculator lets you see how your money can grow using interest compounding.

- The future balance of $1,000 will be worth $1,127.49 after two years if the compounding period is daily.

- That’s not enough to retire comfortably, but what if you doubled your monthly investment?

- Simply divide the number 72 by the annual rate of return to determine how many years it will take to double.

- In other words, use the same interest rate, but different amounts.

- The interest is determined by the premium amount, the annuity’s term, and income withdrawn.

- Compound interest is the interest on savings calculated on both the initial principal and the accumulated interest from previous periods.

When there’s compound interest, the money you earn each year is added to the money you already have. So, instead of just growing, the accumulated interest grows at an increasing rate which helps save for retirement or invest in stocks. Compound interest also accounts for the effects of inflation and repaying debt.

Now for the more complicated case – deposit replenishment with equal monthly installments. Note that the factor degree mn nothing more than the number of periods of interest accrual. The main reason for this is that, when you use compound interest, you earn more money at the end of the investment period than when using simple interest.

How much interest do 2 million dollars earn?

As you can see, this is a very complex formula, and unless you’re a math whiz, you probably won’t get it right the first time. Calculate the future value after 10 years present value of $5,000 with annual interest of 4%. Number of Years to Grow – The number of years the investment will be held. Expectancy Wealth Planning will show you how to create a financial roadmap for the rest of your life and give you all of the tools you need to follow it. If you take out a loan, then compound interest can help you to find out how much you will owe at the end of the loan period.

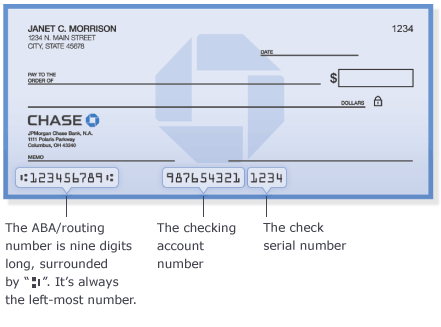

Now we also can’t use the same rate, because if we have n as 10, and we used our annual rate, then this would be compounding annually for ten years. In order to adjust the rate, we must divide it by 2, since we are now earning 2% per period rather than 4%. This may seem a little confusing, but just remember that no matter how many periods over which your principal is compounding, your compounding rate must match the length of the period. If you want to know how much interest your investment will earn, our compound interest calculator can help. Contact us today to request a service quote or learn more about our products and solutions. Compound interest formulas are the interest rate you earn on your money during a compounding period in a financial institution or insurance company savings account.

Banks generally provide saving accounts with yearly capitalization of the interest while investments in stocks that pay a dividend have yearly, quarterly or monthly payments. Use this calculator to easily calculate the compound interest and the total future value of a deposit based on an initial principal. Let’s say you invest $1,000 in an account that pays 4% interest compounded annually. In order to calculate the future value of our $1,000, we must add interest to our present value. Because we are compounding interest, we must reinvest our interest earned so that our interest earned also earns interest. These example calculations assume a fixed percentage yearly interest rate.

Monthly contribution

More so if you look at the graph below, the benefits of compound interest outweigh standard interest by $45,122.55. ______ Addition ($) – How much money you’re planning on depositing daily, weekly, bi-weekly, half-monthly, monthly, bi-monthly, quarterly, semi-annually, or annually over the number of years to grow. Just enter your beginning balance, the regular deposit amount at any specified interval, the interest rate, compounding interval, and the number of years you expect to allow your investment to grow. This calculator calculates accreted amount when using compound interest and additional monthly investment. The calculation of interest is also expected to be monthly (the most favorable case). Here you should type in the amount which you will periodically add to the initial investment.

Over 10 years, a $100,000 deposit receiving 5% simple annual interest would earn $50,000 in total interest. But if the same deposit had a monthly compound interest rate of 5%, interest would add up to about $64,700. Jacob Bernoulli discovered e while studying compound interest in 1683. He understood that having more compounding periods within a specified finite period led to faster growth of the principal. It did not matter whether one measured the intervals in years, months, or any other unit of measurement. Each additional period generated higher returns for the lender.

A compound interest calculator is a powerful tool for anyone who wants to save money and calculate compound interest. This tool will teach you how to calculate and use one to make your money work better. We’ll also explore the benefits of a compound interest rate, including its long-term effect on your savings account or investment portfolio. This compound interest calculator is a tool to help you estimate how much money you will earn on your deposit. In order to make smart financial decisions, you need to be able to foresee the final result.

They invest $5,000 initially, then $500 monthly for 15 years, also averaging a monthly compounded 4% return. By age 65, your twin has only earned $132,147, with a principal investment of $95,000. Compound interest can significantly boost investment returns over the long term.

Each tool is carefully developed and rigorously tested, and our content is well-sourced, but despite our best effort it is possible they contain errors. We are not to be held responsible for any resulting damages from proper or improper use of the service. Future Value – The value of your account, including interest earned, after the number of years to grow. Beginning Account Balance – The money you already have saved that will be applied toward your savings goal.

Investment Accounts That Compound Interest

The first way to calculate compound interest is to multiply each year’s new balance by the interest rate. Interest Earned – How much interest was earned over the number of years to grow. By using the Compound Interest Calculator, you can compare two completely different investments. However, it is important to understand the effects of changing just one variable. The conventional approach to retirement planning is fundamentally flawed.

Let’s take a look at what to do when the rate given is not the rate per compound period. Using our compound interest calculator, $2,000,000 invested can earn up to $335,480 in interest over five years. If you save and invest over a long period, compounding can help you reach your financial goals. You will earn more money on your initial balance than you started. For example, $100 with a fixed rate of return of 8% will take approximately nine (72 / 8) years to grow to $200.

Also, an interest rate compounded more frequently tends to appear lower. For this reason, lenders often like to present interest rates compounded monthly instead of annually. For example, a 6% mortgage interest rate amounts to a monthly 0.5% interest rate.

The Power of Compound Interest: Calculations and Examples

It also allows you to answer some other questions, such as how long it will take to double your investment. Note that in the case where you make a deposit into a bank (e.g., put money in your savings account), you have, from a financial perspective, lent money to the bank. So, in about 24 years, your initial investment will have doubled. If you’re

receiving How to Prepare Journal Entries with Simple Explanation Accounting Education 6% then your money will double in about 12 years. You can include regular withdrawals within your compound interest calculation as either a monetary withdrawal or as a percentage of interest/earnings. If you invested $10,000 which compounded annually at 7%, it would be worth over $76,122.55 after 30 years, accruing over $66,122.55 in compounded interest.

Financial institutions often offer compound interest on deposits, compounding on a regular basis – usually monthly or annually. The main difference between these two types of interest is on what exactly interest is earned. When simple interest is used, interest is mainly accrued on the initial amount of money deposited.

Bernoulli also discerned that this sequence eventually approached a limit, e, which describes the relationship between the plateau and the interest rate when compounding. Hence, if a two-year savings account containing $1,000 pays a 6% interest rate compounded daily, it will grow to $1,127.49 at the end of two years. Generally, compound interest is defined as interest that is earned not solely on the initial amount invested but also on any further interest.

Say in our previous example that we earned interest semiannually rather than annually. Because n represents the number of compounding periods, and we are compounding semiannually for five years, there will be 10 compounding periods. We multiply five years by a compounding frequency of two (twice per year) to arrive at the number of compounding periods.