During the year it charged depreciation of $10 and there were no fixed asset additions during the year. Calculate total asset turnover, fixed asset turnover and working capital turnover ratios. Publicly-facing industries including retail and restaurants rely heavily on converting assets to inventory, then converting inventory to sales. Other sectors like real estate often take long periods of time to convert inventory into revenue. Though real estate transactions may result in high profit margins, the industry-wide asset turnover ratio is low.

How to calculate total asset turnover? Applying the total asset turnover ratio formula

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. F1[b], F1[e] – Statement of financial position (at the [b]eginning and at the [e]nd of the analizing period). Additionally, you can track how your investments into ordering new assets have performed year-over-year to see if the decisions paid off or require adjustments going forward. Thus, a sustainable balance must be struck between being efficient while also spending enough to be at the forefront of any new industry shifts. Yarilet Perez is an experienced multimedia journalist and fact-checker with a Master of Science in Journalism. She has worked in multiple cities covering breaking news, politics, education, and more.

Company

- However, interpreting this value as being good will also depend on the average asset turnover ratio of the industry to which the company belongs.

- Selling off assets has the effect of artificially inflating the asset turnover ratio.

- Since the total asset turnover consists of average assets and revenue, both of which cannot be negative, it is impossible for the total asset turnover to be negative.

- He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem.

It may be an indication that the company is not efficiently using its assets to generate sales. Generally, a low asset turnover ratio interpretation suggests that the company has problems with surplus production capacity, poor inventory management, or bad tax (or revenue) collection methods. When evaluating the asset turnover ratio, it’s imperative to recognize that industry characteristics can lead to significant variations in what constitutes a ‘healthy’ ratio. Industries that are capital intensive, such as utilities or telecommunications, typically have lower asset turnover ratios due to the high investment in infrastructure required to operate. The asset turnover ratio’s significance in financial performance analysis is multifaceted.

Step 1: Find your net sales.

The average value of the assets for the year is determined using the value of the company’s assets on the balance sheet as of the start of the year and at the end of the year. Total sales or revenue is found on the company’s income statement and is the numerator. The asset turnover ratio measures the value of a company’s sales or revenues relative to the value of its assets.

Its relevance extends beyond mere numbers; it reflects strategic decisions and operational effectiveness, influencing investment choices and corporate valuations. However, like any financial tool, it carries inherent limitations that must be acknowledged to avoid misinterpretation of a company’s fiscal health. Average total assets value is calculated by adding the beginning and ending balance of total assets and dividing the sum by 2.

This simply means that whether a company’s asset turnover ratio is considered good or poor would depend on its industry as well as the value of the asset turnover from the company’s previous records. Nonetheless, generally, an asset turnover ratio result that is higher than those in the same industry would be interpreted as the company being better at moving products to generate revenue. A firm that outsources manufacturing may have a higher asset turnover due to lower asset base, while a company that invests how to make a commercial invoice heavily in its own production facilities may have a lower ratio. This doesn’t necessarily indicate inefficiency, but rather reflects different strategic approaches to asset utilization. Total asset turnover ratio should be looked at together with the company’s financing mix and its net profit margin for a better analysis as discussed in DuPont analysis. If a company can generate more sales with fewer assets it has a higher turnover ratio which tells us that it is using its assets more efficiently.

A high asset turnover ratio indicates that the company is more efficient in generating revenue from its assets. If the asset turnover ratio of a company is greater than 1, it is considered a high ratio. The Fixed Asset Turnover Ratio (FAT) is found by dividing net sales by the average balance of fixed assets. Once this same process is done for each year, we can move on to the fixed asset turnover, where only PP&E is included rather than all the company’s assets.

Therefore, for a comparative asset turnover ratio interpretation to be valid, only the ratios of companies that are in the same sector should be compared. Hence, it would not be proper to compare this ratio for businesses in different sectors. The asset turnover ratio uses total assets instead of focusing only on fixed assets. Using total assets reflects management’s decisions on all capital expenditures and other assets. A technology company like Meta has a significantly smaller fixed asset base than a manufacturing giant like Caterpillar.

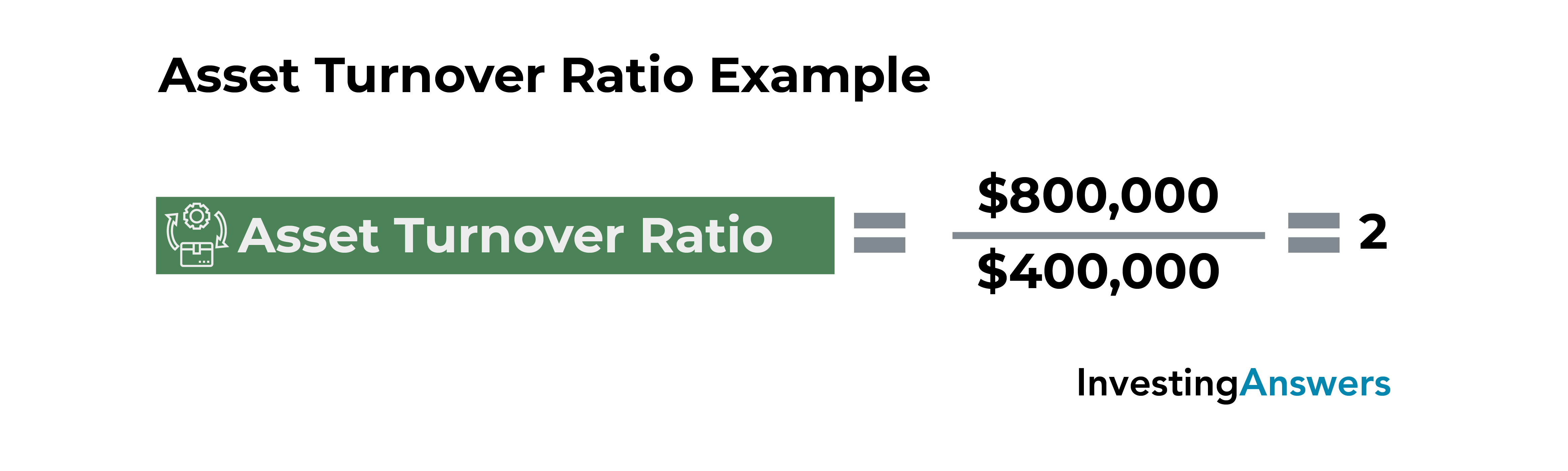

The ratio calculates the company’s net sales as a percentage of its average total assets to show how many sales are generated from each dollar of the company’s assets. For instance, an asset turnover ratio interpretation of 1.5 would mean that each dollar of the company’s assets generates $1.5 in sales. The fixed asset turnover ratio formula divides a company’s net sales by the value of its average fixed assets.

On the other hand, in industries with few competitors or high barriers to entry, companies might not face the same pressure, which could result in lower asset turnover figures. Asset turnover ratio is the ratio of a company’s net sales to its average total assets. It is an asset-utilization ratio which tells us how efficiently the company is using its assets to generate revenue. Also, keep in mind that a high ratio is beneficial for a business with a low-profit margin as it means the company is generating sufficient sales volume.