On the other hand, a company with a low DOL has a huge portion of its overall cost structure as variable costs. The calculator produces the income statement of the business based on the quantity of units entered in Step 2. Integrate DOL calculations into your financial planning strategies for better long-term decision-making. Understanding how changes in sales volume affect your operating income allows for more precise forecasting and budgeting.

Operating leverage vs. financial leverage

- A high DOL can be good if a company is expecting an increase in sales, as it will lead to a corresponding operating income increase.

- Common examples of industries recognized for their high and low degree of operating leverage (DOL) are described in the chart below.

- If you have the percentual change (period to period) of sales, put it here.

- It provides insights into a company’s sensitivity to changes in its operating income due to variations in sales.

A company with a high DOL can see huge changes in profits with a relatively smaller change in sales. On the contrary, companies having low operating leverage may find it effortless to earn a profit when trading with lower sales. The higher the degree of operating leverage, the greater the potential danger from forecasting risk, in which a relatively small error in forecasting sales can be magnified into large errors in cash flow projections. Next, if the case toggle is set to “Upside”, we can see that revenue is growing 10% each year and from Year 1 to Year 5, and the company’s operating margin expands from 40.0% to 55.8%.

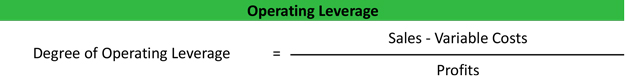

Example Calculation of DOL

Basically, you can just put the indicated percentage in our degree of operating leverage calculator, even while the presenter is still talking, and voilà. However, it resulted in a 25% increase in operating income ($10,000 to $12,500). A high DOL can be good if a company is expecting an increase in sales, as it will lead to a corresponding operating income increase. However, a high DOL can be bad if a company is expecting a decrease in sales, as it will lead to a corresponding decrease in operating income. For example, in a company with high DOL, a 10% increase in sales could lead to a more than 10% increase in EBIT, magnifying the impact on profitability.

What is the approximate value of your cash savings and other investments?

Financial leverage is a measure of how much a company has borrowed in relation to its equity. Typically, companies that have a large proportion of fixed cost to variable cost have higher levels of operating leverage. The formula is used to determine the impact of a change in a company’s sales on the operating income of that company. Most of Microsoft’s costs are fixed, such as expenses for upfront development and marketing. With each dollar in sales earned beyond the break-even point, the company makes a profit, but Microsoft has high operating leverage.

This variation of one time or six-time (the above example) is known as degree of operating leverage (DOL). Regardless of whether revenue increases or decreases, the margins of the company tend to stay within the same range. If sales and customer demand turned xero accounting software review 2022 out lower than anticipated, a high DOL company could end up in financial ruin over the long run. As a result, companies with high DOL and in a cyclical industry are required to hold more cash on hand in anticipation of a potential shortfall in liquidity.

In other words, greater fixed expenses result in a higher leverage ratio, which, when sales rise, results in higher profits. If a company has high operating leverage, then it means that a large proportion of its overall cost structure is due to fixed costs. Such a company will enjoy huge changes in profits with a relatively smaller increase in sales. On the other hand, if a company has low operating leverage, then it means that variable costs contribute a large proportion of its overall cost structure. Such a company does not need to increase sales per se to cover its lower fixed costs, but it earns a smaller profit on each incremental sale.

The contribution margin represents the percentage of revenue remaining after deducting just the variable costs, while the operating margin is the percentage of revenue left after subtracting out both variable and fixed costs. That indicates to us that this company might have huge variable costs relative to its sales. Similarly, we can conclude the same by realizing how little the operating leverage ratio is, at only 0.02.

It is important to compare operating leverage between companies in the same industry, as some industries have higher fixed costs than others. So, whether you’re a seasoned financial pro or a business owner looking to optimize profitability, keep this guide handy. With the right tools and understanding, you can leverage your fixed costs to drive financial success. The benefit that results from this type of cost structure is that, if sales increase, the company’s profits will also increase correspondingly. Now, we are ready to calculate the contribution margin, which is the $250mm in total revenue minus the $25mm in variable costs. The direct cost of manufacturing one unit of that product was $2.50, which we’ll multiply by the number of units sold, as we did for revenue.

The calculator is used to calculate the DOL by entering details relating to the quantity of units sold, the unit selling price and cost price, and the fixed costs of the business. Conversely, Walmart retail stores have low fixed costs and large variable costs, especially for merchandise. Because Walmart sells a huge volume of items and pays upfront for each unit it sells, its cost of goods sold increases as sales increase.