The corresponding accounts are credited with the amounts debited to balance the entries. The entries are based on cash or on credit as the respective accounts have to be credited back due to the return. When you purchase inventory from vendors, there are times when those goods become damaged or cannot be sold as a result of a recall. In these instances, you can return the goods to your suppliers for a refund or credit toward future orders.

How to Record Sales Returns and Allowances

- It doesn’t have to create the purchase returns and allowances account for the returns transaction like those that follow the periodic inventory system.

- Sometimes, however, companies may not return goods to suppliers.

- In order to clearly understand the accounting for purchase returns and allowances, let’s go through the example below.

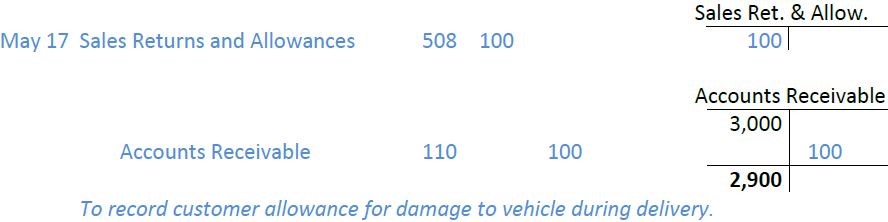

- We know the amount of the sale has changed along with the amount owed on the receivable.

- Both Accounts Payable decreases (debit) and Merchandise Inventory-Printers decreases (credit) by $1,500 (15 × $100).

In our example for Hanlon, May 4 was FOB Destination and we will not have to do anything for shipping. On May 21, shipping terms were FOB Shipping Point meaning we, as the buyer, must pay for shipping. Under the periodic inventory system, we will debit Transportation (or freight) In for the shipping cost and credit cash or accounts payable depending on if we paid it now or later. But if you don’t know how to account for a return with a purchase returns and allowances journal entry, your books will be inaccurate. Passing these journal entries helps companies determine the exact stock in their inventory by reducing the returns from their suppliers.

Purchase Returns and Allowances Transaction Journal Entries

Since goods purchase return journal entries reduce the outstanding payments of the company, they are recorded on the credit side. If you need to refund a customer for a purchase they made from your business, you will need to create a purchase return journal entry. This will help you track the returned merchandise and ensure that the vendor or supplier provides you with a credit for the returned items. In the first entry, we debit the accounts receivable account and credit the purchase returns and allowances account.

Journal Entry under the Perpetual Inventory System

Purchase return and allowances are the contra account of the purchases account in the periodic inventory system. In the perpetual inventory system, the purchase return and allowances are adjusted directly by reducing the merchandise inventory account. Under the periodic system, the company needs to make the purchase return journal entry by debiting accounts payable or cash account and crediting purchase returns and allowances account. No, the journal entries are the same whether merchandise is returned for a credit note or for a refund of cash. In both cases, the accounts payable or accounts receivable account is debited, and the purchase returns and allowances account is credited.

Cash and Credit Purchase Transaction Journal Entries

The payment terms are 5/10, n/30, and the invoice is dated May 1. Accounts Payable decreases (debit), and Cash decreases (credit) for the full amount owed. First, let’s look at this from the perspective of Medici Music, the buyer. Medici is returning inventory, which means the balance in the inventory account is decreasing. Medici also owes less money to Whistling Flutes because the merchandise is returned.

Let’s assume that ABC Co buys goods to its supplier on 02 January 20X1 for $3,500. In the purchase agreement, ABC Co would be able to return the goods if there is any damage or defect. On 05 January 20X1, ABC Co finds out that some of the goods received are defective.

Merchandise Inventory decreases to align with the Cost Principle, reporting the value of the merchandise at the reduced cost. Since CBS already paid in full for their purchase, a cash refund of the allowance is issued in the amount of $480 (60 × $8). This increases Cash (debit) and decreases (credit) Merchandise Inventory-Phones because the merchandise is less valuable than before the damage discovery. Notice the entries for returns and allowances are the same for the buyer. In both cases the dollar value of the inventory has changed, so the entry is the same.

It is not a reduction in the price of goods or services before the delivery. Similarly, it does not offer an early settlement discount, excluding it from cash discounts. Any entry relating to the return of merchandise purchased for cash is recorded what is target profit and how is it calculated in a cash receipts journal. Sales returns occur when a customer does not accept goods and returns them to the seller for a full refund or credit. A sales allowance occurs when a customer chooses to accept such goods but at a reduced price.

Purchase returns, in short, are goods that a company returns to its suppliers. There are several reasons that a company may return these goods. Companies incur expenses that are essential in helping generate revenues. Purchases are goods or services obtained or acquired to fund a company’s operations. These differ from other expenses which do not directly contribute to a company’s revenues. Instead, purchases are a part of a company’s part of sales and the direct expense for revenues.