Contents

Despite being insightful when it comes to detecting price directions, divergence should be integrated within a full technical analysis to confirm its reliability. Bullish divergence indicates that the price is about to move higher. Reproduction or redistribution of this information is not permitted. Draw key support and resistance lines, and spot the divergence by looking at the highs/lows. Below is an example of bearish divergence on the EUR/USD currency pair. There are different indicators traders can use to identify divergence.

- Divergence in forex trading happens when the price of the traded currency pair is moving in the opposite direction of a technical indicator, usually an oscillator.

- The standard divergence bias shows how the possible reversal may take place.

- Calculate the Compound Annual Growth Rate of your investments with our easy-to-use CAGR Calculator.

- The following tool, which can detect divergence in automatic mode, works based on the popular OsMA indicator.

Every trader takes notice of the volume of trades in determining the signal strength. Traditionally, there are two types of divergence, namely, Regular Divergence and Hidden Divergence. The divergence shows different predictions, and understanding them ultimately can work as a divergence cheat sheet for the trader. The bullish divergence rising trend started around 50 levels.

The indicator of divergence the Fx5 Divergence

It is free to download and easy to apply on the MT4 terminal. In addition, it provides valuable information about the market, which can be a little confusing for new traders to understand at the beginning. These regular and reverse divergence signals simplify the traders’ task of putting in extra efforts to recognize every divergence correctly. If you want further confirmation, you can see the candle pattern, or based on the RSI’s oversold situation depiction; you can enter a trade. The stop-loss point should be established near the low end and exit where the RSI divergence moves towards a downtrend. To pin out the buy and sell movement on the indicator, you need first to find the bearish and bullish divergence.

Identify when the trading price moves in the opposite direction of the oscillator indicator such as MACD or RSI. Procrastination to trade is when your trading set up confirms and you hesitate to take trade. Or your trade show all failing signals and you hesitate to close trade to cut losses. Also, in cases, where you sometimes hesitate to take profit because you want to… Hidden divergences are not strong reversal points like the regular divergences. To measure price momentum and at the same time to generate market direction signals.

By signing up as a member you acknowledge that we are not providing financial advice and that you are making the decision on the trades you place in the markets. We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade. Divergence is a popular term in technical analysis that describes when the price of an asset is moving in the opposite direction of a technical indicator. So how can we best maximize the profit potential of a divergence trade while minimizing its risks? First of all, although divergence signals may work on all timeframes, longer-term charts usually provide better signals.

They are only an assistant for traders who have not yet learned to visually detect the divergence between price and oscillator. To trade divergence in the forex market, you need to identify the moment when the trading price moves in the opposite direction of the oscillator indicator such as MACD or RSI. After bullish or bearish divergence identification, you need to enter into a trade when the price touch an important price level . Fundamental traders relate divergence to the situation when the trend and the indicator move in different directions. Divergence can be classified into two parts, negative and positive.

What technical indicators do people use when looking for divergence?

ForexSignals.com helps traders of all levels learn how to trade the financial markets. If the trade becomes favorable, on the other hand, you can continue to scale in until your intended trade size is reached. If momentum continues beyond that, you should hold the position until momentum Investigational New Drug slows or anything larger than a normal pullback occurs. At the point that momentum wanes, you then scale out of the position by taking progressive profits on your fractional trades. However, except for bullish and bearish divergence, there is one more – triple divergence.

There will be losing trades, just like any other systems out there, but as long as the winners outweigh the losers, you’ll be fine in the long run. In most cases, divergence appears on oscillating indicators (those that “revolve” around the mid-line). These are indicators such as MACD, RSI, Stochastic, CCI, etc. Imagine that you are sitting in the cockpit of an airplane, and then suddenly, the instruments begin to signal that you are sharply decreasing. At the same time, it is clearly outside the window, and you see that everything is in order with the plane.

The red arrows and lines indicate that the signal appears downwards. Accordingly, the arrows and lines of blue color are formed when there is a divergence that suggests buying a currency pair. The indicator local extrema are marked with blue, https://1investing.in/ red and white dots. Similarly, a negative divergence occurs when the RSI starts failing and makes a lower top despite share prices moving higher. Since there is less power or support for the new higher price a reversal could be expected.

We use the information you provide to contact you about your membership with us and to provide you with relevant content. I’ve been a trader for many years and this has also helped me because of the 24hr liv… Forex Signals provides some of the best education for people new to Forex and trading… ForexSignals.com is the best trading education platform I have found after 4 years of… Calculate the Compound Annual Growth Rate of your investments with our easy-to-use CAGR Calculator. Use our profit calculator to calculate the possible profit from a trade you are considering taking.

When the downward trend approaches with a signal of continuation, it is known as Hidden Bearish Signal. It indicates that the price will start to fall and will continue to fall for a while. This divergence approaches when the price shows a lower high while the indicator shows a higher high. This is When price action hits higher highs or lower lows and momentum oscillators doesn’t. In order to spot the divergences in the Forex markets, you have to compare price movement to an oscillator movement.

Hidden Bullish Divergence

Spot divergence by comparing the oscillator’s movements to price movements. Scroll back in time and identify 10 instances of divergence across 5 different charts. This will give you 50 examples including both wins and losses.

Divergence is one of the strongest reversal signals you can get. But do keep in mind, this is a reversal trading strategy whereby you are fading the current trend. Whether or not this imperfection in the signal was responsible for the less-than-stellar results that immediately ensued is difficult to say. Any foreign exchange trader who tried to play this second divergence signal with a subsequent short got whipsawed about rather severely in the following days and weeks. However, a hidden bullish divergence between the EURUSD price and the RSI joins a fortnight-old ascending trend line to keep buyers hopeful.

If the price is making higher highs, the oscillator should also be making higher highs. If the price is making lower lows, the oscillator should also be making lower lows. When traded properly, you can be profitable with divergences.

How To Detect Divergences Trading Strategy?

Without an indicator, the trader can not ascertain the movement of the trend. This becomes even more crucial when using a momentum oscillator like RSI , CCI , or Williams %R. Divergence is when the price is moving in the opposite direction of a technical indicator like RSI, oscillator or MACD. It is a very powerful signal in forextechnical analysisand can efficiently signal a price reversal. The main purpose of divergence is to recognize the imbalances between price movements and technical indicators, assuming that imbalances signal potential changes in price trends.

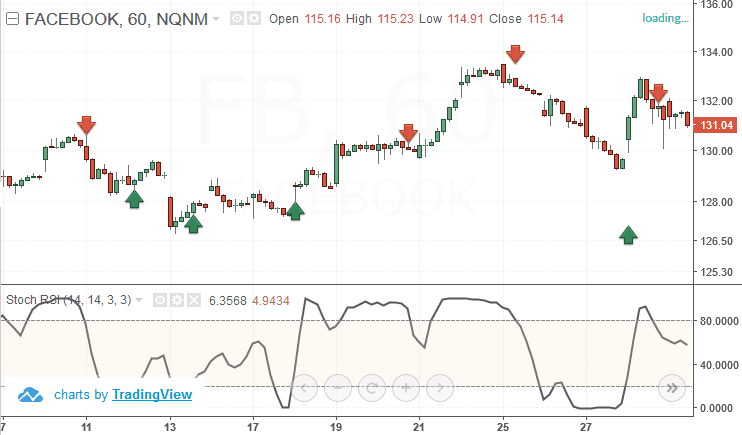

However, the results vary with the currency pairs and the chosen indicator. Among all, we have shortlisted the top three oscillator indicators that can be very helpful in your trading. It has the same principle of spotting divergences, but it is based on the standard indicator from the MetaTrader 4 terminal – Stochastic. The instrument is considered to be the most accurate, but it has the same drawbacks as the previous two ones. In order to test it personally, one should just download the archive and install it to the chart of any currency pair. One can search for divergences manually, or just use the appropriate tools.