As with performing payroll functions in-house, applicable taxes must be withheld by the provider before payments are made. The process of managing employee payroll is often time-consuming—unless, that is, another company is hired to take care of it instead. Payroll outsourcing can lead https://www.business-accounting.net/accumulated-depreciation-land-improvements/ to big cost savings and provide access to payroll management experts, but doing so also comes with unique challenges and risks. Our 2024 guide takes you through the ins and outs of how payroll outsourcing works and how your company can best evaluate a possible outsourcing strategy.

Best for Seasonal Businesses

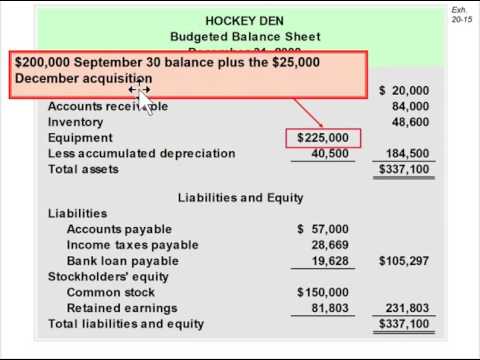

This means that you need to keep time cards, spreadsheets and copies of checks and deposits for this period of time should an audit or a discrepancy arise. Note that the current percentages for Social Security is 6.2% for the employer and 6.2% for the employee. The Medicare rate is 1.45% for the employer and 1.45% for the employee. Make sure you set aside the right amount from the employee’s gross wages and from your own business account to pay these required taxes.

View Employee Information

Wave offers two plans based on the state in which you operate your business. If you operate in one of the 14 states in which Wave offers tax services, you will pay a higher base monthly rate to take advantage of these services. All other states must remit payment and file variance in accounting their taxes themselves and so will pay a lower monthly base rate for Wave’s payroll solution. TriNet has a 3.8 and 4.0 star review on Capterra and G2 respectively, with 649 user reviews total. Users say the software is extremely easy to use and has comprehensive features.

Access Critical Reports

You’ll need to withhold federal and state taxes for each employee based on their allowances. Use the IRS Withholding Estimator to determine how much in federal taxes you must withhold for each employee. Check with your state tax assessor’s office to determine the right amount to withhold for state taxes. Taxes are usually paid monthly, so collect them, set them aside and make payments as required. Paychex Flex Select provides expert service to match your business needs to our solutions. Process payroll, file taxes online, and have access to online employee training and development with 24/7 support.

Outsourced Payroll Service

Justworks’ standout feature is its professional employer organization (PEO) services, allowing businesses to outsource some HR and payroll tasks. Justworks is a professional employer organization (PEO) that appeals to remote teams. The company engages client companies in a co-employment relationship, serving as an employer of record for your employees. Based on what I was able to play with in the platform, Gusto guides you through payroll and benefits management in a way that makes these processes less overwhelming. You can be sure you’re completing tasks in the right order without missing a step.

What are payroll services?

Your employees can access their info through easy-to-use tech 24/7. A paycheck is an electronic deposit or a physical bank check with the amount of money you’ve been paid. A pay stub outlines all the calculations and deductions needed to arrive at the correct take-home pay. Money movement services are brought to you by Intuit Payments Inc. subject to eligibility criteria, credit and application approval. QuickBooks Payroll has what you need to stay compliant, from labor law posters to expert support.

After reconciling it, you’re ready to run payroll, which means approving direct deposits and the preparation of checks. It can take a few days for direct deposits to fully transfer to employee accounts and for checks to be printed and distributed. Some payroll products offer same-day or next-day direct deposit, but others may need longer than that. Until you’re sure how long it will take to complete https://www.accountingcoaching.online/ payroll by payday, it may be helpful to allow some extra time for processing. Your accountant will probably appreciate that you’re using a trusted payroll service provider because it enables seamless data integration, reporting and payroll processing. This empowers accountants to do more work with greater efficiency, so they have more time to work on strategies that help you run a better business.

If you’re already using QuickBooks for accounting, then QuickBooks Payroll is our easiest to set up option, as everything will be automated, and it’s going to be an intuitive program for any QuickBooks user. You’re unlikely to need to contact support for help because the tutorial and knowledge base are so thorough. Even if that’s not working for you, a quick search online will send you to a multitude of walkthroughs.

- Save time and reduce costly errors when you connect and share data between our payroll software, Paychex Flex®, and dozens of other business applications.

- If you have data from another payroll service that you want to import into OnPay, you can get help, and OnPay guarantees accuracy.

- It also provides easy access to mandatory forms, such as W-2 and W-9, and notifies you about changes to minimum wage, tax codes and other regulations.

While it is less expensive, it does run the risk of errors in calculations and withholdings. Employers need to file wages paid to employees, taxes withheld, Social Security and Medicare deductions and employer’s contributions to Social Security and Medicare. The first few payrolls will likely be the most difficult as you walk through the process and get used to what you need to do. It may be helpful to consult with a tax professional or accountant to make sure that you are checking everything in the process. Our total HR solution provides you the HR services, support, and benefits that your one-of-a-kind small business needs.

If you’re switching providers, you can ease the transition process by asking for all the necessary forms and information upfront. Set payroll to a schedule, so your team gets paid on time, every time. No matter what industry you’re in – Paychex payroll is here to help you simplify payday, automate tax filing, and stay compliant with changing regulations. Identify discrepancies and possible costly errors with Paychex Pre-check℠, allowing admins and employees to preview paystubs before your payroll processes. Access critical information or work with a dedicated HR professional to help stay up to date on federal, state, and local legislative changes – while our payroll management system helps simplify your payday. The IRS says to store payroll records for at least four years from the date when the taxes are due or from the date that you made the payment―whichever is later.

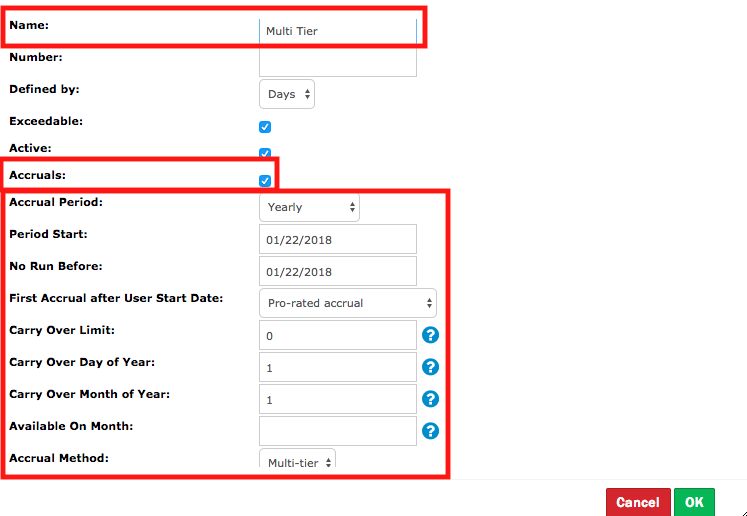

Set up and track employee paid time off and manage paid, unpaid, sick, and vacation time. Everything included in our “Plus” package and automated time-tracking with Time and Attendance. Includes ADP’s latest HR tools such as live HR support, employee handbook wizard, proactive compliance alerts, HR guidance and forms, and a job description wizard.

Workful is trying to be a single software solution, which is why it offers built-in time tracking, document storage, and HR options. However, if you’re happy with your time-tracking solution, use a different accounting program, or need Indeed or Zapier integrations, Workful isn’t the right payroll software for you. If you prefer handling payroll on your own, payroll software can help you save time, automate certain processes and reduce the chance of mistakes. Many products can handle payroll tax filing and payments on your behalf, but you’re still ultimately on the hook for meeting those obligations.

Task workflows were self-explanatory and required minimal effort on my part. It kept signing me out and requiring me to sign back in in the middle of tasks. This was a minimal disturbance but still a disturbance that cost me time and effort to handle.

In addition, when I contacted the chat support to ask if I had missed any customization options, I was given irrelevant responses and prompted to contact customer support via email. Once set up, the account brought me to an initial reporting dashboard. The dashboard had a handful of reports and optional action items but didn’t feel cluttered or overwhelming. Wave Payroll’s standout features include employee and contractor payroll tools, tax services, an employee self-service portal and invoicing tools. For managing contract employees, the platform auto-generates Form 1099 when needed and grants contractors self-serve access to key tax documents. It also allows you to customize how you pay contracts with multiple pay options.

In the event that you happen to miss a payroll tax filing or you get audited, not having proper documentation can hurt your business. Payroll software will keep most of the required documentation for you without you having to worry about keeping track of anything manually. The primary drawback of this method of managing payroll is the cost, as it’s the most expensive option. Many businesses appreciate the touchpoint with their employees of managing the process and making sure they are the ones that deal with any issues that come up.